Insights

Verfügbare Ausgaben

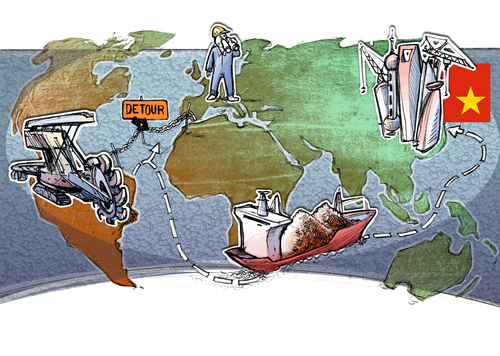

Barbarians at the gate: The unavoidable transition in the global potash fertilizer market

Quarterly Insights on Strategy and Market Dynamics, Ausgabe (September 2013) von Hagen Lindstädt, Christian Preuss, Download

Recent developments in the global potash fertilizer market have led to irreversible changes in the potash game and will ruin potash suppliers’ profitability for the next decade at least. Due to significant investments in capacity by both new and established suppliers, the global potash industry’s historically stable market is currently facing a transition from high margins to more competition, as our analysis shows; this unavoidable change will be permanent. Large suppliers, like Germany’s DAX 30 company K+S basically have a choice between Scylla and Charybdis. From the perspective of economic theory, this is nothing but the transition from a narrow to a wide oligopoly, which shows rules close to those of perfect competition.

Prospects for the 2020 iron ore market: How Europe should prepare

Spotlight on the iron ore and steel industries

Quarterly Insights on Strategy and Market Dynamics, Ausgabe (Dezember 2011)

von Marc P. Bielitza, Hagen Lindstädt, Download

Recent developments in the global iron ore market, driven primarily by the rapid industrialization of China, mark the beginning of deep changes in the structure and dynamics of the market and are putting steelmakers’ profitability at risk. Given iron ore's fundamental role in industrialized economies, European steelmakers and political leaders are seeking indications as to what direction the development of the iron ore industry will take in the coming years. Here’s what they should do to protect the European industry from the harshest consequences.

New Market Entrants in Oligopolies: What Incumbents Can Do

Spotlight on the Basic Materials, Chemicals, and Health Care Industries

Quarterly Insights on Strategy and Market Dynamics, Ausgabe (Oktober 2010)

von Hagen Lindstädt, Kerstin Fehre, Download

New market entries are a fact of life. Multinationals invest huge sums to expand to new markets, small firms grow and turn into serious competitors; start-ups attack established incumbents. The resulting changes in competitive dynamics often have lasting effects on the entire industry. And every single market follows different rules: lots of good reasons why incumbents should think carefully about what the most promising response to new entries will be. Three case examples illustrate this point.

Drug Discount Contracts in Germany: Will We Be Facing a Claim Game?

Spotlight on the Pharmaceuticals Industry

Quarterly Insights on Strategy and Market Dynamics, Ausgabe (Juli 2010)

von Hagen Lindstädt, Petra Dietl, Dominik Drerup, Download

Recent years have seen several health reforms in Germany. Faced with exploding health care costs, government is attempting to reduce public expenditure and promote price competition among suppliers and providers. Among other things, health insurance companies are now entitled to directly negotiate discount contracts with Pharmaceutical manufacturers – which will clearly redefine the rules of the game in the market for prescription medicines. But what will be the outcome? Where is the pharmaceuticals industry heading in the longer run? Is a major price decline inevitable, as some experts claim? We have our doubts.

Collapsing Demand: Can a Price War Be Avoided?

Spotlight on the Potash Industry

Quarterly Insights on Strategy and Market Dynamics, Ausgabe (April 2010)

von Hagen Lindstädt, Petra Dietl, Download

No other industry has been on such a rollercoaster ride. In 2008, potash prices sky-rocketed – and continued their upward surge even when demand started sagging -, in 2009 they took a deep fall as demand collapsed. Admittedly, this is an extreme example. But it is just one of many instances where the global crisis caused a drop in demand. Price wars loom everywhere, and they threaten to affect the long-term profitability of entire industries, in particular those with oligopoly structures. What are the factors driving market dynamics in such situations – and how can the downward spiral be avoided?